A while ago, I used Quicken to manage my finances. It's proprietary software, and year after year, it cost me more and more money for upgrades. Eventually, I realized it isn't prudent to take away from my budget to help me control my budget.

Fortunately, I learned about HomeBank while reading an article about open source money management tools. HomeBank is free personal banking software. It runs on Linux, Windows, and macOS, and it's offered in 56 different languages. These advantages ensure it's available to you no matter your choice of operating system and the language you speak.

Install and set up HomeBank

Once you download the software and run the installer, it will start and run on its own without any compiling, configuration (unless you need to), or extra steps.

I'll use some randomly generated information to do a walkthrough of how to use HomeBank.

Create an account the easy way

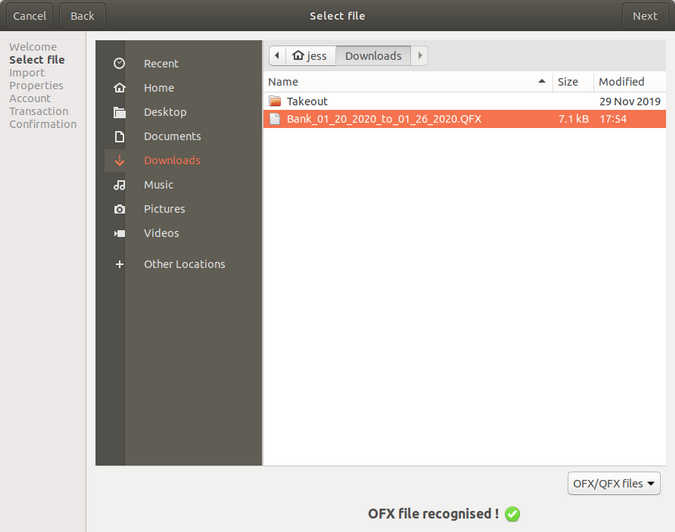

The easiest way to get started with a new account in HomeBank is to import a data file from your bank. Go to your bank's website and log into your account. Find the option to export your account's transactions, identify the time period for which you want your transactions, and select the file type you want. I found the easiest option is QFX; it's widely used in Quicken, so most budget/financial applications know it.

Return to HomeBank and import the data file with File > Import > OFX/QFX. Your new account will be created with all of the transactions for the time period you selected.

Create an account manually

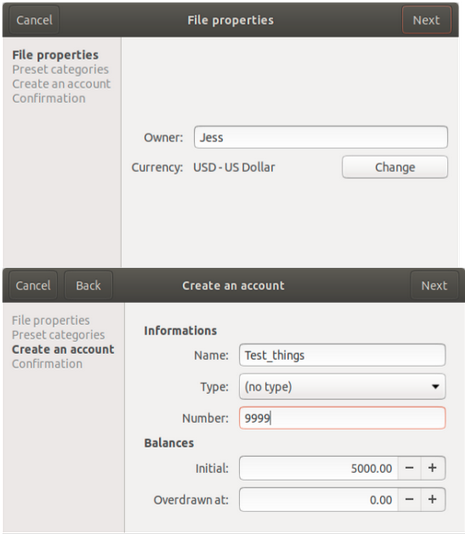

The harder way to start is by manually inputting your account information. Create a new file and set its properties, e.g., owner name, currency, language (you can use the built-in system detection), etc., and create an account as shown in the screenshots below.

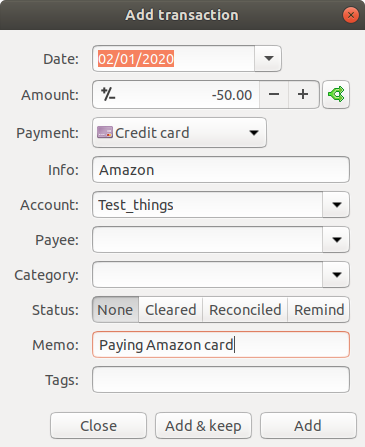

Once all of this is set up, you can add transactions by clicking Transaction > Add. A form will appear where you can add the details for your transactions. The screenshot below shows a payment—all outgoing transactions must have a negative number. Transactions with positive numbers are treated as credits.

Analyze your finances

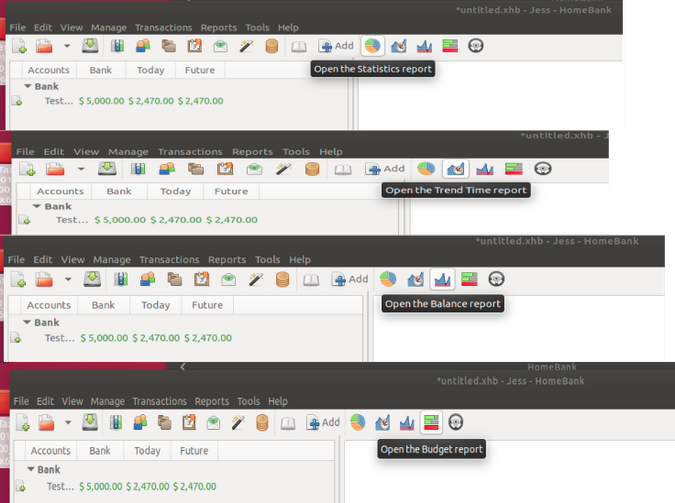

Once you have a sufficient number of transactions in HomeBank, you can use your data for reporting and trending. This gives you a way to visualize where your money is going and helps you identify budget trends.

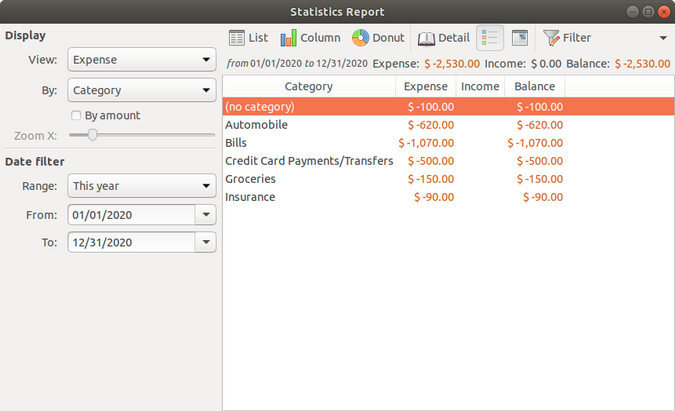

For example, the Statistics Report initially displays details about your transactions' budget categories.

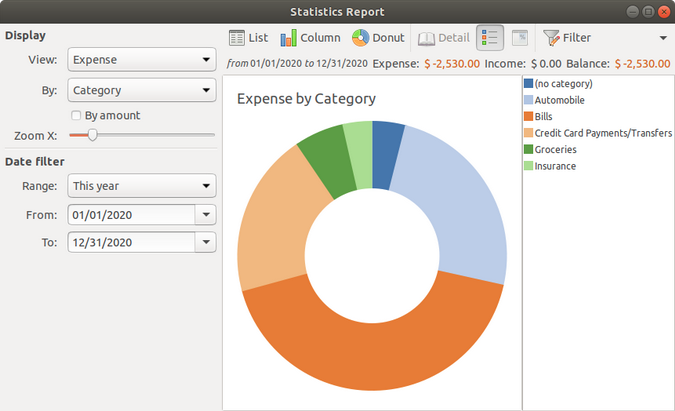

The menu at the top allows you to choose a graphic type to display your data. Here, I chose the Donut graph type.

Now your data is visualized for you to use and work with.

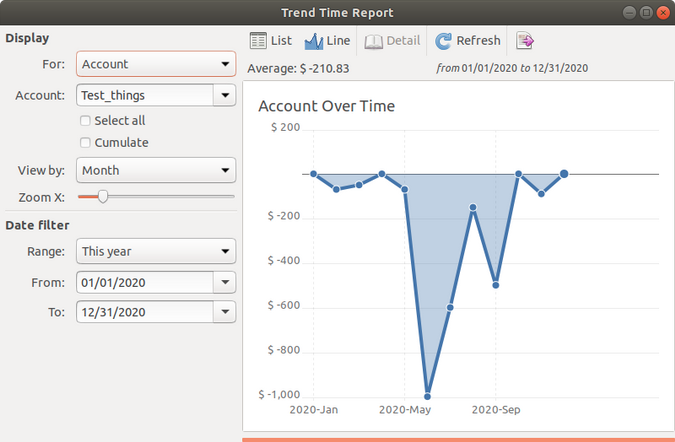

You can also trend your data over time, such as by month for a year, as shown here.

As you add more information, you can trend by day per month or by month per year, based on your needs.

Features

I haven't gotten through all of the features available in HomeBank yet, but here are some I especially like.

Support for various currencies is useful when I have international transactions or am taking a trip and need to run a budget with the right currency.

A scheduling template helps me keep track of all of my recurring expenditures and paychecks. I can also create more than one template quickly and add them all at once. This gives me a more stabilized budget because I know what's incoming and outgoing regularly.

Finally, I found vehicle cost in the analytics section particularly valuable. I have been debating using ride-sharing services, and seeing the cost of using my vehicle helped me decide that it makes more sense to split my time between working from home more and using a ride-sharing service to get to the office.

Happy budgeting!

HomeBank offers more than I can cover in this brief overview, but I hope these basics give you some good ideas to get more control over your budget this year. I like that this software gives me the opportunity to use my data to do more analytics and make better choices about my spending habits.

If you need more information, HomeBank offers an extensive amount of documentation, and if you want to look over everything, go ahead and check out HomeBank's website.

6 Comments